While not as exciting as M&A and organic growth, increasing operational efficiency typically is a significant value-creation opportunity for middle market food & beverage manufacturers.

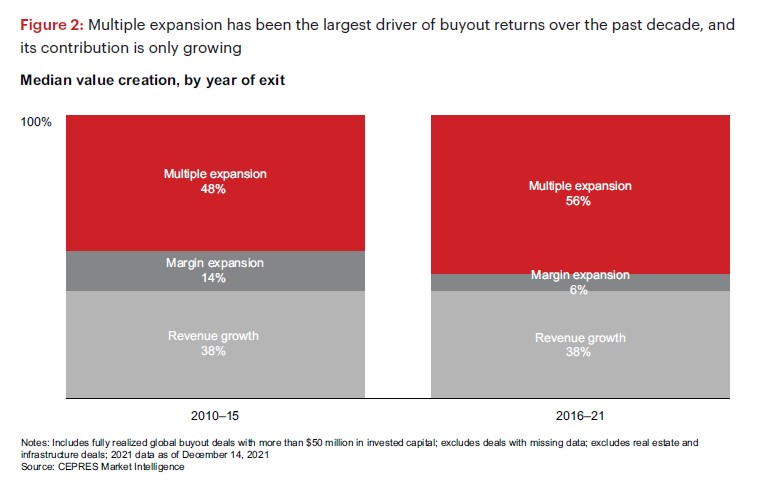

Yet a Bain Consulting study in 2023 found that ~90% of the Private Equity returns in the prior decade came from multiple expansion and revenue growth (often M&A driven), versus just ~10% from margin expansion.

With today’s higher interest rates, lower valuation multiples and longer holding periods, margin expansion will be an important source of differentiation in the years ahead.

The good news is that there are meaningful, untapped value creation opportunities sitting in plain view on the shop floor and in the supply chain at most middle market food & beverage manufacturers.

Where to focus

In our experience, the largest value-creation opportunities tend to fall in 4 areas:

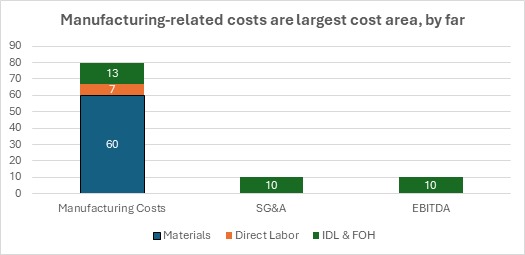

- Procurement: Purchased raw materials and packaging represent a manufacturer’s highest category of spend (~50% to 60% of sales). Yet most middle market manufacturers possess relatively immature capabilities and practices in this area. We estimate that the average middle market manufacturer could reduce its procurement spend by 7% to 10% by enhancing the capabilities and competencies of its procurement department.

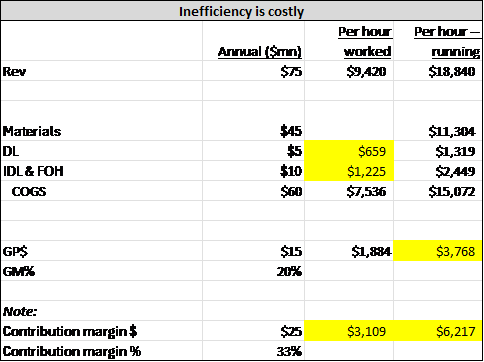

- OEE%: Overall equipment effectiveness (i.e., OEE) in the middle market is commonly well below 50%. Downtime on a single line can cost over $1,500 per hour, and unlocked capacity can be worth multiples of that amount. Thus, small improvements can have a big impact, particularly for manufacturers with significant overtime and/or capacity constraints.

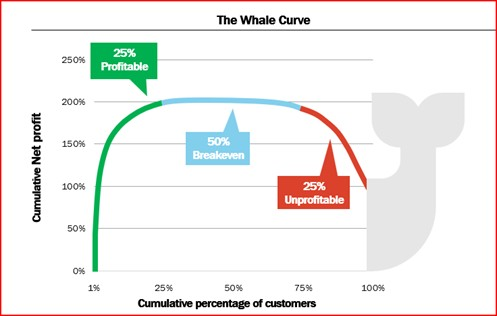

- Product (mis)costing: Most middle market food & beverage manufacturers are not rigorous in documenting their standards and tracking performance against those standards. As a result, they lack needed visibility into the true cost of producing their products. Thus, they frequently end up with numerous money-losing SKUs and customers. Simply addressing these losses can quickly drive substantial EBITDA improvement.

- Inventory: Lastly, food & beverage manufacturers regularly lose several hundred basis points of gross margin in excess scrap, aged and obsolete inventory and overfill — often without being aware of it. If your business has ever sustained a large inventory write-off, that’s generally a sign that there is money to be saved in this area.

Why it matters

The business case for investing behind improving operational efficiency is straightforward.

- Big Dollars. The average middle-market food & beverage manufacturer spends ~$0.80 of every $1.00 dollar of revenue on manufacturing related activities (raw materials, packaging materials, plant labor, overhead, etc.). These costs typically are 5x to 8x larger than EBITDA.

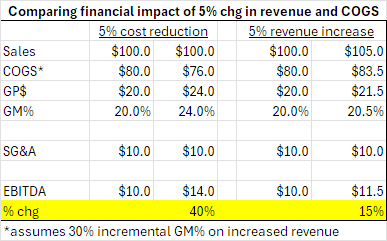

- Direct bottom line impact. Because 100% of efficiency improvements fall to the bottom line (and/or unlock valuable manufacturing capacity), small improvements in operating efficiency have an outsized impact on EBITDA.

- Rapid payback. We find that simply getting started on the journey often yields improvements within just 2-3 months, building the organization’s appetite for more. Importantly, these internally focused activities are your decision alone.

Conclusion

Efficiency improvement opportunities are generally not hard to spot with a trained eye. In fact, in almost all cases, the people working on the floor already know where the opportunities are. Typically, they just need some direction, executive-level support and some resources to go after them.

Importantly, you don’t have to bring your operations to large CPG levels or invest millions of dollars in automation to see results. In our experience, by simply collecting the right information and having an experienced practitioner who can support your operations team, manufacturers can quickly see efficiency gains of 15% or more. Like all journeys, it simply starts with taking the first step.

Can this work be completed internally? Absolutely, provided your operations team has the requisite expertise and time. The challenge we see at middle-market food & beverage manufacturers is that employees are already busy with their day-jobs, leaving few internal resources available to lead focused project work. In these situations, leveraging a 3rd party can deliver a high ROI and allow your business to complete important value-creation initiatives that you might not get to otherwise.